Bitcoin Price Prediction using the Hybrid Convolutional Recurrent Model Architecture

By Omar Mohammed Ahmed | Engineering, Technology & Applied Science Research (ETASR)

https://doi.org/10.48084/etasr.6223

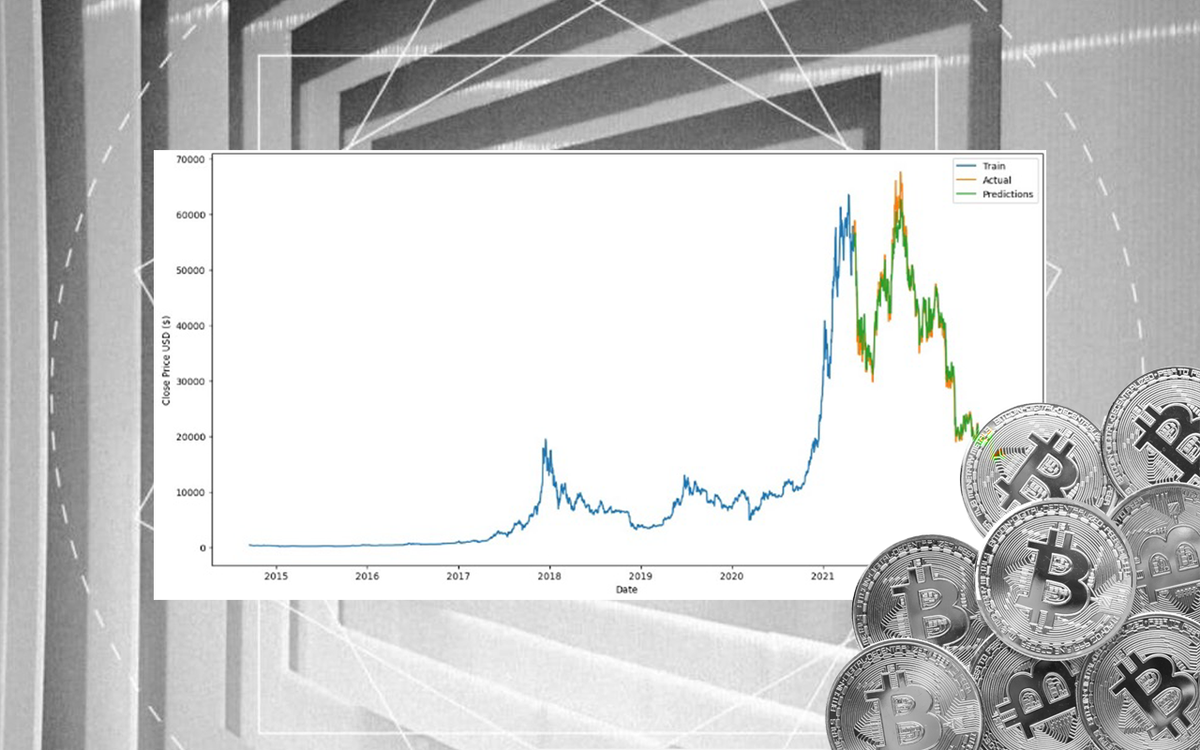

The field of finance makes extensive use of real-time prediction of stock price tools, which are instruments that are put to use in the process of creating predictions. In this article, we attempt to predict the price of Bitcoin in a manner that is both accurate and reliable. Deep learning models, as opposed to more traditional methods, are used to manage enormous volumes of data and to generate predictions. The purpose of this research is to develop a method for predicting stock prices using the Hybrid Convolutional Recurrent Model (HCRM) architecture. This model architecture integrates the advantages of two separate deep learning models: The 1-Dimensional-Convolusional Neural Network (1D-CNN) and the Long-Short Term Memory (LSTM). The 1D-CNN is responsible for the feature extraction, while the LSTM is in charge of the temporal regression. The developed 1D-CNN-LSTM model has an outstanding performance in predicting stock values.